Innovative Solutions for Finacial Growth

Discover strategies to secure high-yielding investments, with potential returns ranging from 15% to over 30% per year. Our expert team provides insights and guidance to help you achieve your financial goals.

Disclaimer: Investment outcomes can vary and are subject to market risks. Past performance is not indicative of future results. Please consult with a financial advisor before making any investment decisions.

High Returns Without a Lock-in Period

Imagine the freedom of earning high returns without being tied down by a lock-in period. Hedge Funds do that!

Why Hedge Funds?

No Lock-in Period: Enjoy the flexibility to access your funds whenever you need them, without any restrictions.

High Returns: Designed to deliver potentially substantial returns, helping you grow your wealth steadily.

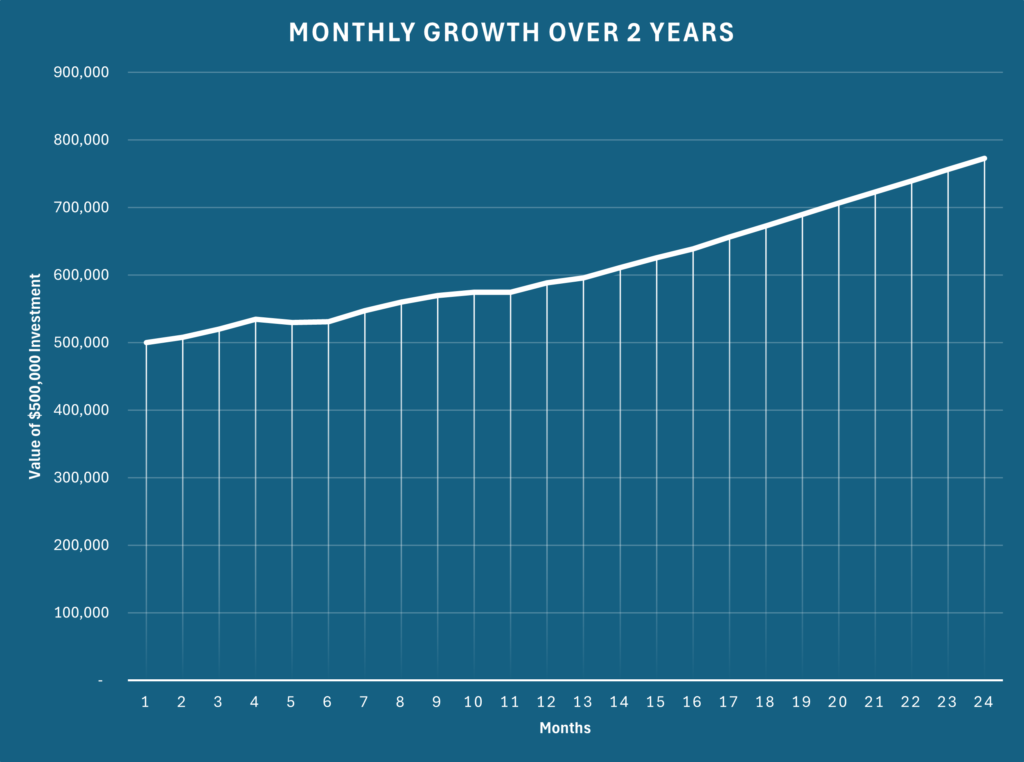

The graph showcases the remarkable performance of fund over a two-year period. With an initial investment of $500,000, a client enjoyed an impressive annual return of $140,000. This means that over the course of two years, the investment generated a total return of $280,000!

02

Experience Flexibility and High Returns

Unlike traditional bank term deposits, hedge funds offer unparalleled flexibility and the potential for high returns. With our hedge fund services, you gain exclusive access to a personalized portal tailored to your investment needs.

Key Benefits:

Flexibility: Your money remains in your own account, allowing you to withdraw both your principal and profits at any time.

Exclusive Access: Enjoy a personalized portal that provides comprehensive investment statistics, including performance metrics and percentage returns.

High Returns: Hedge funds are designed to maximize your investment potential, offering opportunities for significant gains.

Take control of your investments with the flexibility and high returns that hedge funds provide. Access your personalized portal today and start making informed investment decisions.

Are You a Sophisticated Investor

Unlike Property Investments Hedge Funds Can Only be Accessed by Sophisticated Investors

You qualify if you meet any of the following:

– Possessing net assets of $2.5 million,

– Gross income of $250,000 annually for the last two financial years,

– Intend to make a single investment of $500,000

If you don’t meet the first two, you can still meet the criteria if you deposit $500,000 into a fund.

Why A Hedge Fund

01

Good When Markets Are Bad

Hedge funds have the capability to remain profitable even during market downturns. They utilize various strategies such as short selling, derivatives, and arbitrage to take advantage of market volatility. This flexibility enables them to potentially generate positive returns regardless of market conditions, making them an interesting option for those looking to navigate uncertain times.

02

Hedge Fund Strategies and Diversification

Hedge funds often utilize a range of investment strategies, such as long/short equity, arbitrage, and applying global macros. This diversification aims to manage risk and enhance the stability of an investment portfolio.

03

Advanced Risk Management

Hedge funds frequently employ sophisticated risk management techniques to safeguard their investments. These techniques can involve hedging strategies, such as short selling and derivatives, to address potential losses and navigate market volatility.

04

Investment Redemption Flexibility

Hedge funds often allow investors to redeem their investments at regular intervals or on a short-term basis. This feature can offer a level of flexibility that is not always found in other alternative investments.

05

Performance-Based Fees

Hedge fund managers often earn performance-based fees, aligning their interests with those of the investors. This structure incentivizes managers to strive for strong performance and aim to generate positive returns for their clients.

06

Flexibility

Hedge funds possess the flexibility to modify their investment strategies in response to changing market conditions. This adaptability enables them to potentially take advantage of emerging opportunities and manage market downturns more effectively.